I recently calculated the enterprise valuations of the all the NBA teams for 2025 using this method. See the full list here.

As me anything about:

- Why did you decide to calculate the value of the NBA franchise teams? Tell us more about that process.

- How do a team’s arena, including non-NBA revenue, such as concerts, impact valuations?

- Did you discover anything surprising when you were researching the list?

- Private equity seems to be creating stronger ties in the major leagues. Can you tell us more?

- Should we expect that private equity will also make its way into college sports?

- Were you surprised by the sale value of the Boston Celtics?

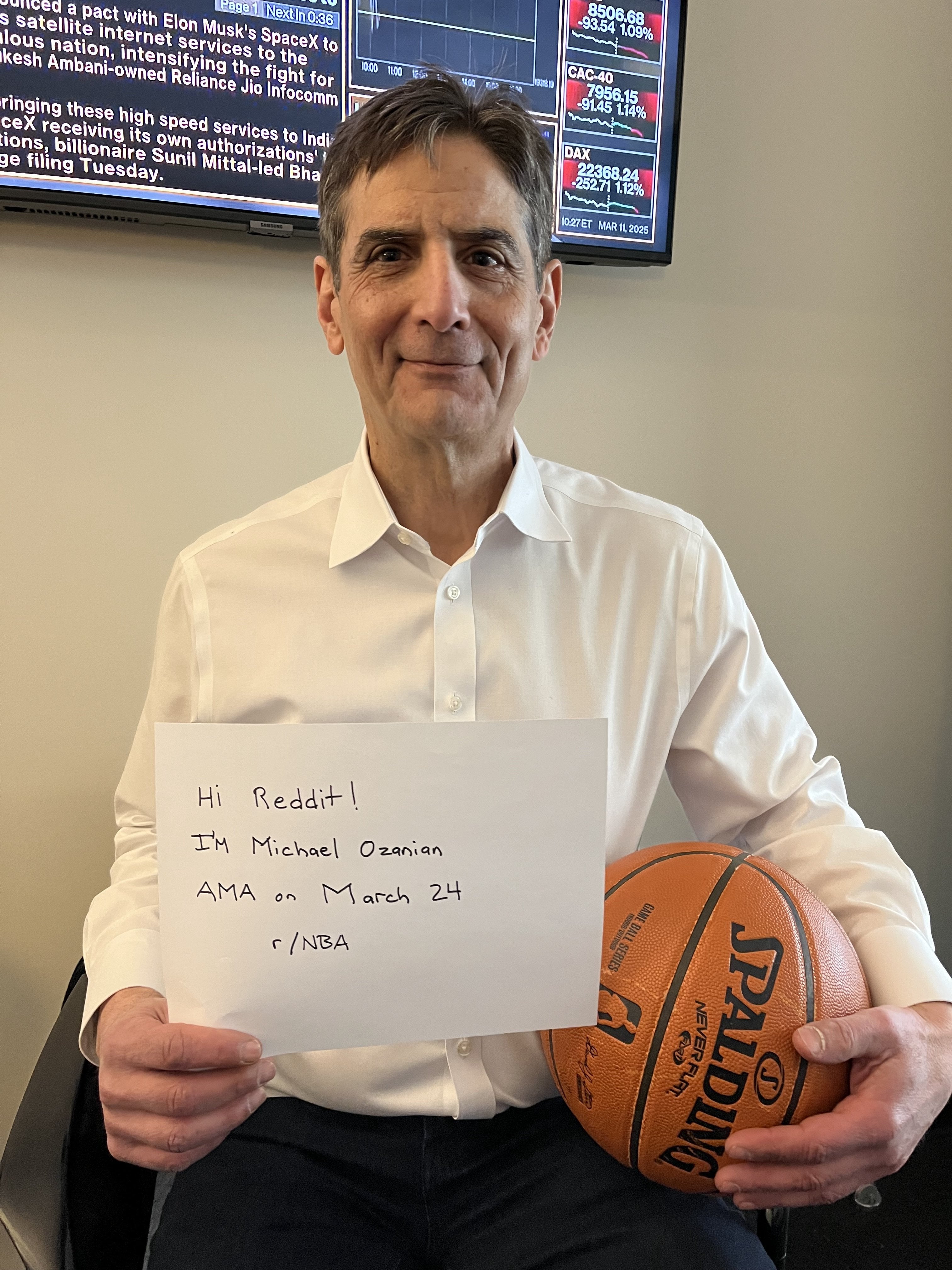

Proof: https://imgur.com/a/AoeM21i

You can find all my reporting here on CNBC.

25 comments

Is pineapple on pizza a good business decision for a sports team?

How do you and your network feel about ESPN being garbage?

So can we ask anything, or only ask anything about your six assigned topics?

How big of a gambling scandal is needed for the NBA to stop shoving gambling crap down fans’ throats?

which ding dong on your social media team thought this was a good idea? I respect your job as a reporter and your career, but this is a waste of your valuable time. Tell whoever thought this was a good idea that they don’t know what they’re doing.

There’s been a lot of noise around the nba viewership this year. Do you think that affects the valuation of teams? And what do you think is the largest contributing factor that has made it such a hot topic?

>Private equity seems to be creating stronger ties in the major leagues. Can you tell us more?

Sixth Street now owns 20% of the Spurs, and presumably also 20% of the Celtics (reported $1b+ commitment to the Celtics bid from Chisholm).

20% stake is the max for equity providers when it comes to NBA ownership, but in this era of multi-billion dollar team purchases, where individuals are not buying teams on their own, but as groups — would entities such as Sixth Street holding multiple 20% stakes across different franchises allow them to leverage an outsized voice in team decisions?

this would do numbers on bluesky

How much of a team’s valuation is driven by team success? Is there any way a team like Memphis could ever be successful enough to not be a bottom-tier value?

Ask me anything!*

*as long as it’s one of 6 predefined questions which I am informed on

You could just answer your own questions and make a big post because I bet you have some insightful things to say.

Does it ever feel like a waste of time trying to cover 30 teams and nearly 600 active players when just about every NBA related social media post yesterday was about LeBron’s son?

I didn’t know Seniors play sports

You realize your proof picture is going to be used for memes, right?

Does team roster construction and draft assets affect the overall valuation of the franchise in your calculations?

wait, by “anything” you mean those six specific questions? i don’t get it man

Did you use a DCF? How did you determine each team specific WACC and terminal values?

Yesterday someone [made the argument](https://old.reddit.com/r/nba/comments/1jfr4w0/rough_math_on_what_boston_sale_means_for/) that, since the Boston Celtics were purchased for $360 million in 2002, it helped set the Bobcats expansion fee at $300 million. Therefore, the argument goes, the Celtics selling for $6.1 billion means the expansion fees will be around there.

Is that how people in the NBA are thinking about this?

Private equity should be illegal

if steph curry manned up and wore an oversized diaper under his league uniform would he still have a tailbone contusion?

Does a Team’s current PR (good or bad) affect the value of a franchise?

Why aren’t you on BlueSky?

Why did you decide to calculate the value of the NBA franchise teams? Are there any non-franchise teams in the NBA that we don’t know about?

Is team ownership becoming a bubble that could burst one day? Clearly the last generation of owners were the most fortunate, buying for $500M or less and selling for multiple billions, but it seems nearly impossible to sell a team like the Celtics for much more than $6.1B. Also, will new owners make enough money year-to-year to cover the long-term debt from buying such expensive assets? It just seems like this isn’t sustainable.

My gosh you guys are so freaking childish in this thread. This is why r/nba gets no mainstream representation, because you have goofballs talking about unrelated stuff and going “wHy ArE yOu HeRe?!” whenever an actual media member stops by.

Why did I have to pay $9 for a bottle of Dasani water at crypto.com arena last week?