In my earlier post, I argued that income tax rates significantly influence NHL team success, particularly in the salary cap era. The visual trend—showing more Stanley Cup wins among low-tax teams—appeared compelling. However, upon conducting a deeper statistical analysis, the evidence is more nuanced than initially presented.

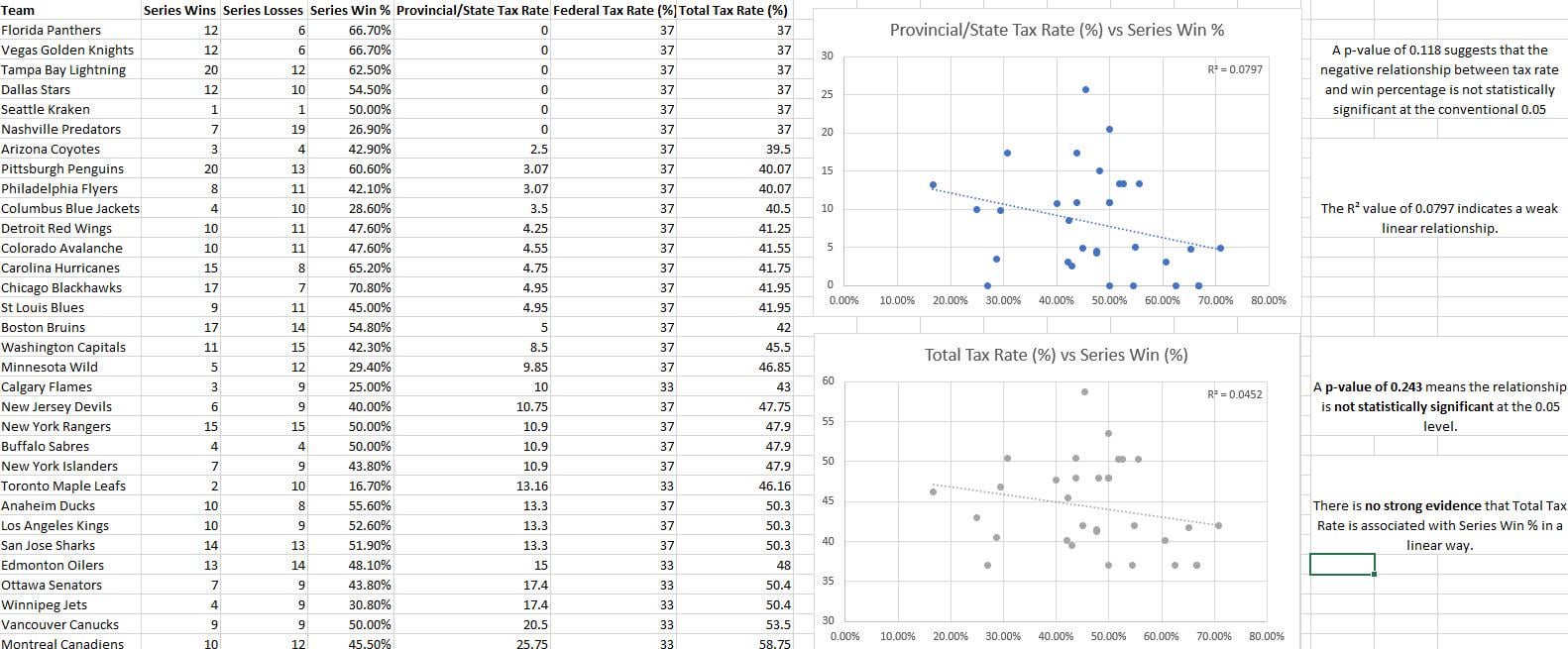

Using linear regression to assess the relationship between tax rate (combined was added) and series win percentage (instead of Stanley Cup Wins), the following results were obtained:

• Total Tax Rate (%) vs Series Win %

R² = 0.0452: Only 4.5% of the variation in playoff series success is explained by total tax rate.

p-value = 0.243: A 24.3% chance the trend occurred due to random variation, well above the conventional 5% significance threshold.

• Provincial/State Tax Rate (%) vs Series Win %

R² = 0.0797

p-value = 0.118

Again, not statistically significant.

These results suggest that while a visual trend exists, the correlation is weak and not statistically reliable.

A p-value above 0.05 means we cannot confidently reject the null hypothesis; in simpler terms, the data does not provide sufficient evidence to conclude that higher tax rates reduce playoff success.

Clarifying the Broader Picture

This does not entirely negate the role of tax policy. It’s well-documented—through player quotes, agent strategies, and league commentary—that take-home pay is a factor in contract decisions, especially when offers are otherwise comparable. However, statistical correlation with playoff wins is far from conclusive.

Several confounding variables likely play a stronger role in playoff success:

• Front office competence and scouting

• Goaltending performance

• Drafting and player development

• Coaching stability

• Injury luck and timing

• Ownership investment

As Commissioner Bettman stated, “Could [taxes] be a little bit of a factor? I suppose. But that’s not it.”

The data supports this nuance: tax policy may influence player decisions, but does not alone predict championships.

Conclusion

In light of this analysis, I revise my original claim:

Tax policy may confer marginal advantages in player acquisition and retention, but it does not statistically predict team success.

The broader dynamics of team building and performance are too complex to attribute playoff outcomes to tax rate alone.

This more rigorous approach underscores the importance of testing visual trends with statistical evidence—and being open to revising conclusions when the data demands it.

If there’s anything else I can improve upon, or criticisms you want to share, please feel free!

12 comments

Lots to unpack here, what did you use for the time frame, what about changes in tax policies during that time frame

Personally think the tax topics are far more complicated and nuance to make grandstanding conclusions in either direction. IE: the way players get paid, salary vs bonus, have different tax values which adds another factor of consideration.

You’re getting closer but I would posit that due to the randomness of hockey and small sample sizes available in the playoffs I would use a ‘points’ system rather than series won/lost.

Regular season win (regulation): 3 points

Regular season win (OT/Shootout): 2 points

Regular season loss (OT/Shootout): 1 point

Regular season loss (regulation): 0 points

Playoff win: 5 points

Playoff series win: 5 points

Then divide the total points by the number of seasons played in that time to come up with a ‘score’.

I’m less concerned about fluctuating tax rates in that time than coming up with an accurate number for overall success by the team. The tax rate fluctuations will more or less average out over time but I think that measuring success solely by playoff series wins is way too random.

Complicating factors that get overlooked near 100% of the time.

Taxes are personal.

You can have two players in the same team with the same aav and they could have significant differences in taxes paid.

1. Tax planning strategies.

Some deductions can drastically reduce the tax paid and taking advantage of it can mitigate the higher tax rate.

2. Tax repatriation laws.

Some countries require you to pay taxes in your home country even on income earned in a foreign country so the players tax rate may not even be effected by local tax rate changes.

3. Contract structure.

Things like deferred salary can reduce taxes paid.

Signing Bonuses are taxed where the player lives rather than where they play so a bonus laden contract could be subject to different taxes rates vs a salary heavy contract.

Of course there is also the fact taxes are paid where players play so 50% of the difference is immediately removed.

I think intuitively it’s clear that having more take-home pay for players can only help a team. But I think it’s also abundantly clear that there isn’t enough data to prove that tax rate has a stat-sig impact on a team’s success.

The problem is that its all conflated with a team’s/city’s general desirability. People before me have all mentioned this but: cost of living, climate, demographics etc.

Let’s consider other industries for instance: tech. Did a lot of tech move to Texas to take advantage of lower tax rates? Absolutely. Is Texas, now the tech sector mecca in the US. No. Places with decidedly higher tax rates still have larger tech presence.

I don’t think the question is if lower taxes help a team. I think the question is magnitude. How much does it help a team? To me, in the current state of the NHL: It’s not large enough to be obvious.

I dont like the dependent variable

I think.playoffs win would be better

Sort of interesting this is,seldom mentioned in other big 4 sports. I am guessing this has to do with there being Candian teams.. Did notice Durantonly wanted Texas/Florida

I wonder why Anaheim has a different tax rate than LA. Aren’t they the same city?

Fair enough, the results don’t prove that taxes produce higher playoff series win percentage.

But the NHL is a pretty small dataset. You need a pretty large effect to ever be able to prove it to a p <.05. In an experiment, you’d try more subjects but you can’t really increase the number of NHL teams.

And logically we know that lower tax should lead to more discount signings. I’m not sure the null hypothesis should really be the default assumption.

I’d say that the results are consistent with the tax issue having a real but not overwhelming impact on team results.

Other things that need to be considered:

Cost of housing (mortgages, property tax, municipal taxes). States like New Jersey or Texas have some of the highest property taxes. But at the same time a mcMansion in Texas is the same cost as a small condo in New York.

A great deal of variability resulting in a weak correlation. It is likely that there are multiple spurious weak correlations with success. Too many confounding and random variables that are difficult to account for. Also, a correlation does not imply cause and effect.

I do think the results will bear out eventually in a more clear cut way, because the teams in no and low tax states have just been perfecting their weaponization of it as a negotiating tactic, and obviously building a team takes time and you need all the ingredients to come together at once so it’s not like it’s a cheat code but it’s definitely a significant advantage.

These teams get their accountants involved in negotiations, show how players can maximize the cash they take home and how they structure contracts etc., and lay out exactly how much more they would make on the same contract as other competing markets.

Wouldn’t Toronto and Ottawa be the same rate?