Image credit:

LSU’s Jay Johnson (Photo by Jay Biggerstaff/Getty Images)

College baseball’s landscape has shifted dramatically in the past decade, with the transfer portal redefining roster construction. What was once a slow churn of attrition and replacement is now a high-volume cycle of arrivals, departures and internal battles that shape depth charts.

The most striking trend is volume. Since the portal’s inception in 2018, entries have climbed every year. When the 2025 window opened on June 2, more than 1,500 Division I players had filed their paperwork by the next morning—doubling the first-day total from last year. It was the latest surge in a system that continues to flood coaches with options to retool rosters overnight.

RELATED CONTENT

Critics often frame the portal as a mechanism that tilts power toward the sport’s giants—and there is some truth to that—but its reach extends far beyond perennial powers. The portal has become a universal marketplace, one that touches nearly every program and reshapes competition at every level of the sport.

Programs that reach Omaha increasingly do so with the help of transfers, often in ways that would have been unthinkable just a few years ago.

LSU offers a clear case study. When the Tigers captured the national championship in 2023, their roster featured only seven Division I transfers. The headliners—Paul Skenes and Tommy White—were so impactful that they masked the relatively modest volume, but the broader makeup of that roster still leaned on players developed in-house.

Two years later, the picture is strikingly different. In 2025, LSU carried 14 Division I transfers, accounting for 35% of its roster. Jay Johnson’s team was still stocked with blue-chip recruits, but the scale of outside additions illustrates how much the transfer portal has become embedded in roster design, even for the sport’s most resource-rich programs.

And LSU is hardly alone.

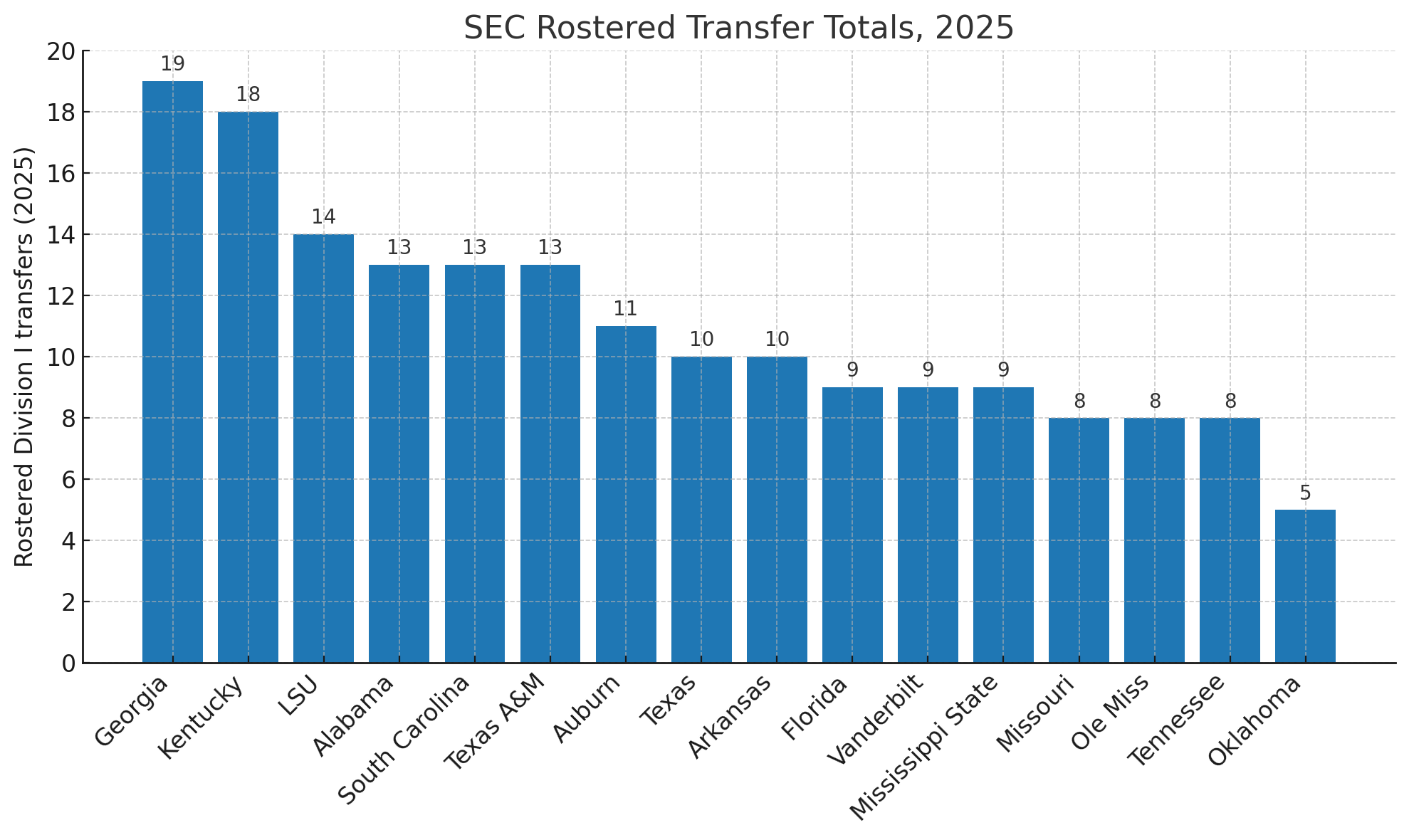

Across the SEC, the reliance on transfers has reached staggering levels. Georgia led the league with 19 Division I transfers on its roster in 2025, while Kentucky followed close behind at 18. Programs like Alabama, South Carolina and Texas A&M all landed in the low teens, with 13 apiece. Even traditional recruiting powers such as Florida (nine), Tennessee (eight) and Vanderbilt (nine) carried significant transfer totals—proof that the portal has become a core component of roster-building strategy regardless of a program’s recruiting pull.

All told, the average SEC roster in 2025 featured more than 11 Division I transfers, a figure that would have been unimaginable just a few years ago.

It’s a reflection of the league’s arms race: a conference that already dominates in facilities, recruiting and NIL resources now adds the portal as another lever to maintain its grip on the sport. The margins for young players to break through in this environment have grown thinner, while the expectation for instant contribution has only intensified.

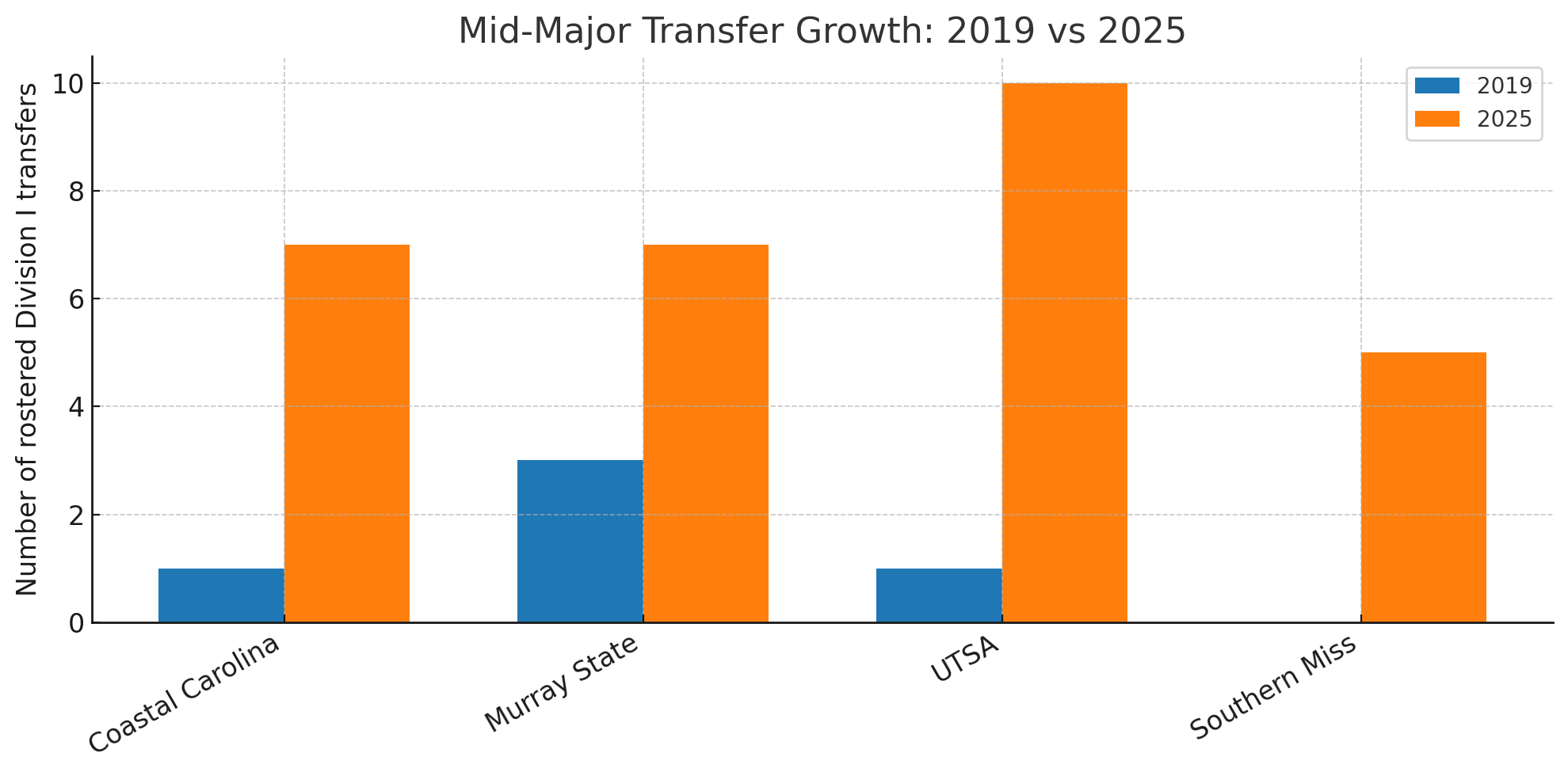

The trend extends well beyond the SEC, too. The rate of transfer entry is rising everywhere, and its imprint is just as clear at the mid-major level. Of the four mid-major programs that finished the season ranked in the Top 25, each has seen a dramatic rise in its transfer totals compared to 2019, the first full season after the portal opened.

Coastal Carolina carried seven Division I transfers in 2025 after rostering just one in 2019. Murray State, one of this year’s surprise Omaha qualifiers, listed seven compared to three six years ago. UTSA’s jump was even sharper, with 10 Division I transfers in 2025 versus a lone rostered transfer in 2019. And Southern Miss, which did not roster a single Division I transfer in 2019, had five this season.

The portal has not just reshaped the balance of power at the top—it has become a universal mechanism for roster construction. Mid-majors use it to plug holes and remain competitive against the sport’s elite, while power programs use it to layer experience on top of elite recruiting classes.

The effect is a transfer-driven ecosystem that touches nearly every corner of Division I baseball.

So why does this all matter?

“This is killing high school recruiting,” one current Division I recruiting coordinator said. “What we’re looking for now is so different than what we were looking for a decade ago, maybe even less than that to be honest. We just don’t have the roster spots.”

That sentiment captures the heart of the shift. The volume of transfers entering Division I programs each year has compressed opportunities for high school players, changing how staffs evaluate prospects and allocate scholarships. Where coaches once leaned on projecting development over three or four years, they now prioritize players who can contribute immediately, especially if they come from another four-year program.

The downstream effects ripple across the sport. Roster churn has become a defining feature of the calendar, forcing both players and programs to think in shorter windows than ever before.

And the acceleration isn’t slowing down.

This offseason alone, 61 Division I programs took at least 10 transfer commitments, with 12 of them adding 15 or more. Just a year ago, only 36 teams reached double-digits. In 2023, that number was 20. The trend line is steep, and it underscores how rapidly the portal has gone from supplemental tool to central mechanism in roster construction.

That shift doesn’t just change who is on the field—it changes how the sport operates. Coaches now budget roster space differently, high school recruiting has been squeezed and the balance between patience and instant production tilts harder every year toward the latter.

It all adds up to a sport where roster stability is the exception, not the rule. The transfer era has created opportunity for players and flexibility for programs, but it has also introduced volatility, pressure and a new kind of arms race. What was once a gradual cycle of growth and development is now a high-speed marketplace.