Atlanta Braves Holdings, Inc. released their third quarter numbers on Wednesday. Yes, one of the benefits of the Braves becoming an asset of a large corporation and later spun off is that they are compelled to tell us all about their money. You don’t get that kind of transparency with the Miami Marlins or the Pittsburgh Pirates. Who knows what they’re up to. But the Braves had a good third quarter of the year. There’s some good and disappointing in the release, but I’ll share with you what publicly available info is out there and make some guesses about what it means for their future. If you’re not as familiar with the Braves financial setup and how they make money, please check out this article from three months ago that has much more detail.

Let me say this first: no one is going to talk you into buying or selling or holding any securities here. We’re here to provide Braves news and analysis and a means to vent about the dumb-ass baseball moves they often make. Second, even if I had a take on a stock you still shouldn’t listen to me about finance, but rather you should make the choices that fit your financial needs. The public gets a chance to see what the Braves are up to financially and that’s the only reason for the news and analysis here.

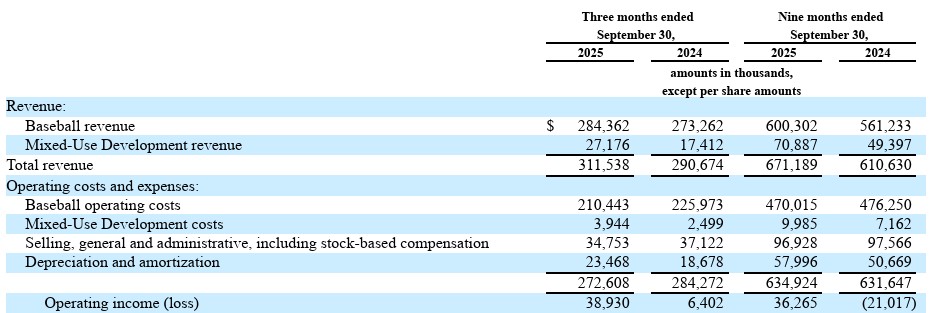

The top line numbers are really quite good. Baseball revenue is up, revenue from the Battery Atlanta and other properties is up, and expenses are down. From Business Wire:

Total revenue grew to $312 million in the third quarter of 2025, up 7% from the prior year period.Baseball revenue increased 4% from the prior year period to $284 million.Mixed-Use Development revenue grew 56% from the prior year period to $27 million.Total Adjusted OIBDA(1) grew to $67 million in the third quarter, up 114% from the prior year period.Baseball Adjusted OIBDA grew 105% from the prior year period to $50 million.Mixed-Use Development Adjusted OIBDA grew 62% from the prior year period to $20 million.

The Braves are over 47 million dollars better off this year from the last. The Mixed-Use Development aka Battery Atlanta, Pennant Park, and the conference areas and field of Truist Park is a big revenue driver for the Braves. Fifty-six percent growth is very sexy. Baseball revenue being up 4% is good considering the 2025 Braves team never really got going. And baseball costs are down because, well, you know, the whole thing about not resigning some players and not substantially filling in the gaps.

The Braves didn’t really benefit from the All-Star Game

I guess I was the only person who thought they would have this large windfall, but that didn’t appear to happen. And if they did and the second half ticket sales were that then, woof. They did indirectly benefit, as they were surely able to add value to their season tickets with the ability to purchase tickets to All-Star Week events. The Battery Atlanta surely brought in some money during that week as well. But baseball event income was only up 4%, which is a little disappointing.

The Braves have the ability to spend

Boy howdy, are they not broke. 47 million dollars more profit over last year is huge. On the conference call, they stated that they have a stockpile of 150 million dollars in cash. They also have access to 215 million dollars in revolving debt facilities aka money the Braves can spend at their discretion. This doesn’t mean that they are going to make a splash in the offseason or spend “crazy” or “stupid money.” But they have plenty of headroom to increase payroll, if they decide to do so.

Terry McGuirk was asked if the Dodgers had broken baseball with their spending. He didn’t comment on what the Dodgers have done, because, yeah. But he reiterated his stance that he would like to see the Braves have a top 5 payroll. They have said this a lot in the past, however. I doubt they will make our offseason fantasies come true, but they should be able to do something.

The Braves are “actively evaluating” ticket pricing

The results call included the news that they had 24 sellouts, which is strong considering their record. They claim that the premium seating options are sold out for 2026. They are also “actively evaluating” their other ticket prices. The Braves were asked about the large price hike in season tickets from 2025 to 2026. My understanding is that the increase from 2025 to 2026 was as high as 2024 to 2025. They responded by saying that the Braves do offer lower price options, which I found as an awkward response.

They were also asked about what their average price per ticket this year. As mentioned, they said they were evaluating their ticket pricing, but didn’t provide a clear answer on the issue. Actually, the rep from Citi responded with “that was helpful”, which translated I think means “that didn’t answer the question”. I understand the issue. It would be helpful if you’re trying to put a valuation on the stock if you knew what the price per ticket is, especially since most of their income comes from ticket sales. But I don’t think it’s as easy as average ticket price anymore.

Sports teams are able to price the premium seating behind home plate, in the suites, and in the club level differently. You can raise much more money from this clientele that the rest of us. The New York Knicks make more profit from a floor seat than some entire sections of the regular seating. So it doesn’t make sense to compare the two.

From my experience, the Braves will definitely serve you both premium options and also nosebleed seats. So if you just want to hang with the kiddos and enjoy the game, it’s pretty reasonable compared to other sports. It’s everything else that’s really high, including concessions. Tickets in the lower bowl seem high for what you get, and it appears that the season ticket crowd is feeling that way as well. But it sounds like now they may be willing to cut you a deal.

The Battery Atlanta and Pennant Park are a gold mine

Revenue from their mixed-use development properties are up 56% year-over-year. That’s amazing, y’all. They have Pennant Park 90% full without having to build anything on the property. There will be 150 hosted events inside Truist Park’s conference areas and the field in 2025. There will be another 150 events at the Roxy this year. This helps them earn money when the team is not actively holding a game. It’s already over 10% of their revenue and it’s just heating up. They would be losing money without it. The areas around the ballpark are full on gamedays, and they could probably have double the space they have and keep it full right now. I know not everybody was not crazy about the Pennant Park purchase, but this is how they supplement their revenue.

The Braves are gonna try to ensure you have a good time. Whether or not that comes with a playoff appearance or not is yet to be determined. I don’t know if they will collect more baseball ticket related revenue in 2026 versus 2025. I have a feeling that last year’s results will affect how eager the fans are to pay any more in 2026 than this year.