Residents of Overland Park and Leawood, the Sunflower State epicenter of a possible taxpayer-funded Kansas City Royals stadium, prefer that the Royals and the Kansas City Chiefs remain at the Truman Sports Complex rather than relocate.

That’s the outcome of a public opinion poll sponsored by the Sentinel’s owner, Kansas Policy Institute, and conducted by SurveyUSA.

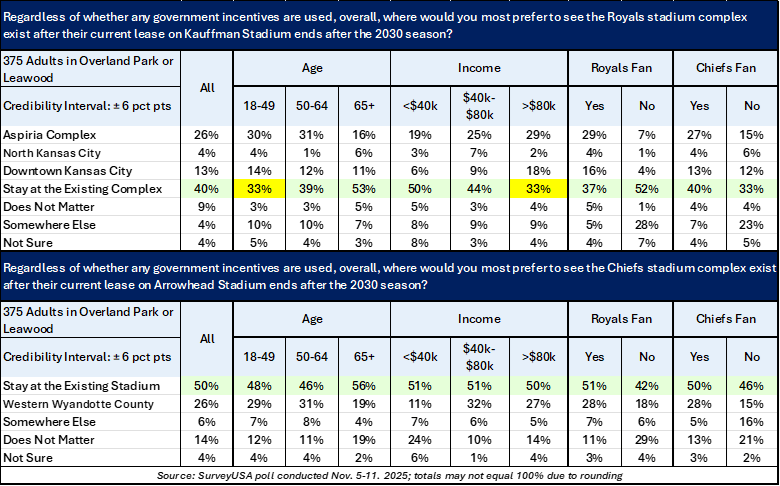

Only 26% of those surveyed think the Aspiria Complex at 119th and Nall in Overland Park is the best place for a new Royals stadium, while 40% say the Royals should stay at Kauffman Stadium in Missouri’s Truman Sports Complex; only 13% prefer a downtown Kansas City location. Fans won’t get their wish, however, as Royals owner John Sherman is on record saying the Royals will vacate Kauffman Stadium after their lease expires in 2030, if not sooner.

Half of those surveyed say the Kansas City Chiefs should stay at Arrowhead Stadium, and 26% prefer a move to western Wyandotte County. The preferences hold across most age and income categories for the Chiefs stadium, and only those aged 18-49 and with incomes over $80,000 are within the six percentage points confidence interval (33% to 30% and 33% to 29%, respectively. A confidence interval is SurveyUSA’s terminology for what is commonly called a margin of error./

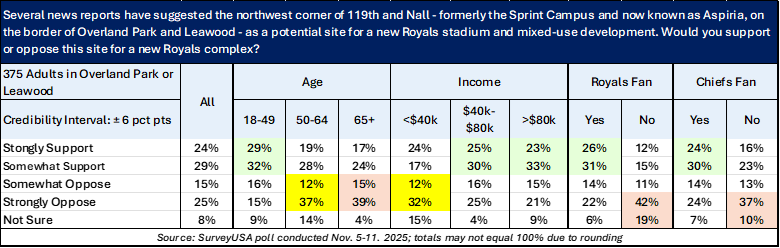

Asked specifically about locating the Royals stadium at the Aspiria Complex at 119th and Nall, 53% would support the move, and 40% are opposed.

Adults aged 18-49 support the location, but those aged 50-64 are opposed within the margin of error and those aged 65 and higher are opposed. Those with income below $40,000 slightly oppose the use of taxpayer subsidies, but those with higher incomes are supportive

Use of taxpayer subsidies to build Chiefs or Royals stadiums

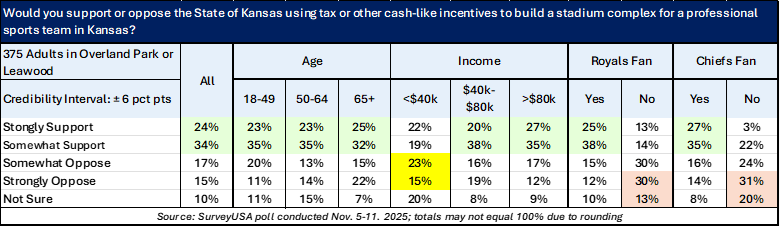

While those surveyed prefer the Chiefs stay in Missouri, they are OK with the State of Kansas offering tax subsidies to build professional sports complexes by a margin of 58% to 32%, with 10% uncertain.

Support across age and income groups is relatively strong, although those with incomes below $40,000 are slightly opposed.

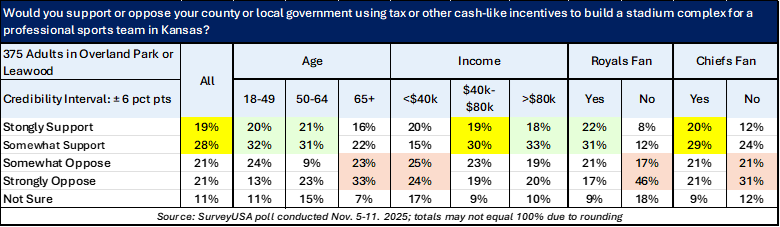

However, more participants are skeptical about the use of local tax subsidies, likely because of concern over property taxes.

Overall, 47% support the use of local tax subsidies and 42% are opposed, making the issue a bit of a toss-up within the margin of error. The income level split is noteworthy, with support for local incentives among middle to lower incomes. People with less than $40,000 are strongly opposed (56% # to 38%), and those with incomes between $40,000 and $80,000 are supportive within one point of the margin of error ($49% to 42%), and those with incomes above $80,000 support local incentives by a 51-39 margin.

Post Views: 44