Tom Hicks, the American businessman who once owned the Dallas Stars, the Texas Rangers, and had a major stake in Liverpool FC, passed away on December 6, 2025, at the age of 79. For decades, he lived between boardrooms and stadiums. He was a deal-maker who used big Private equity moves to buy sports franchises.

Under his ownership, the Stars won the Stanley Cup. He brought hope and investment to baseball in Texas by owning the Rangers. He also stepped onto the global football stage by acquiring part of Liverpool, a bold move that attracted worldwide attention.

Tom Hicks’ death closes a chapter on a career that bridged business ambition with sports passion. This article revisits how he rose, what he built, and why his legacy remains complicated.

Early Business Empire: The Deal-Maker from Texas

Tom Hicks built his name in private equity. He co-founded Hicks, Muse, Tate & Furst. The firm grew by buying companies with borrowed money. That playbook made him rich and bold. It also shaped how he bought sports teams later in life. His deals used heavy leverage. That choice would later create risk when markets turned. Sources note Hicks’ private equity roots and early rise.

The Texas Chapter: Stars and Rangers: Big Bets, Mixed Returns

Hicks bought the Dallas Stars in the mid-1990s. Under his ownership, the Stars won the Stanley Cup in 1999. Fans still praise that title run. The club invested in talent and marketing during his tenure. The NHL itself posted a formal notice after his death.

A few years later, Hicks purchased the Texas Rangers. He poured money into the club. The Rangers reached the 2010 World Series, a high point that came near the end of his ownership. Yet the Rangers also faced mounting debt linked to Hicks’ broader financing methods. The team and its creditors had to navigate complex financial arrangements as the global economy weakened after 2008.

Business decisions that worked in corporate buyouts did not always translate cleanly to sports. Leveraged deals left franchises vulnerable when revenues fell. Analysts point to that mismatch as a key reason for later legal fights and forced sales.

The Liverpool Era: Global Ambitions Meet Fierce Backlash

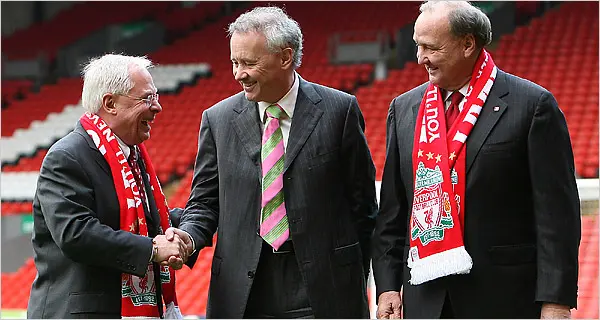

Hicks and George Gillett took a 50% stake in Liverpool FC in February 2007. The aim was to turn Liverpool into a global commercial powerhouse. The new owners promised a stadium plan and fresh investment. Early goodwill with fans quickly eroded. Promised projects stalled. Debt and poor public relations deepened mistrust.

The New York Times Source: Two American Buyers Purchase Liverpool Club

The New York Times Source: Two American Buyers Purchase Liverpool Club

Supporter protests followed. Slogans such as “Yanks out” captured the mood in the stands. The relationship between owners and supporters became openly hostile. Court battles and creditor pressure then accelerated the club’s change of hands. In October 2010, Fenway Sports Group bought Liverpool, ending Hicks and Gillett’s turbulent tenure. That sale reshaped the club’s future and governance.

Debt, Court Fights, and Forced Exits

Across his sports holdings, debt was the common thread. Lenders, investors, and partners’ disputes created legal fights. The Liverpool case reached the High Court and played out in public. Creditors pressed for repayment. Fan groups mounted pressure. The cumulative strain forced Hicks to cede control of several assets. Reporting at the time highlights how leverage, market timing, and governance failures combined to unseat him.

For many observers, the Liverpool episode is the clearest example of how private-equity style finance can clash with fan-driven clubs. The case is often cited in studies of sports ownership and financial regulation since it raised questions about transparency and long-term stewardship.

Personal Side: The Man Beyond Money

Tom Hicks kept strong ties to Texas. He supported local causes and gave land for schools. Family mattered to him. His spokesperson said he died peacefully in Dallas on December 6, 2025, surrounded by family. He is survived by his wife, Cinda, six children, and 14 grandchildren, according to family statements and news reports.

Very sad day…

Mr. Hicks was such a legendary American, Texan and Dallasite

As owner he loved those Stars players/teams from the old halcyon 90s and early 2000s, and the feeling was mutual – 100fold

What a great man

Sympathies to Cinda, the boys and Catherine pic.twitter.com/YyZLbBbTUb

— Daryl Reaugh (@Razor5Hole) December 7, 2025

Colleagues remembered him as an energetic negotiator. Some praised his generosity and mentorship. Others criticized his risk tolerance. Those opposing views show a complex personality. He was both a civic donor and a cutthroat investor. That mix defined the public memory of his career.

Legacy: A Cautionary Chapter in Modern Sports Finance

Hicks left a lasting mark on sports ownership. He helped popularize the idea that wealthy investors could bundle teams into commercial portfolios. That approach accelerated the era of cross-border investment in clubs. At the same time, his failures show the danger of heavy leverage in fandom-sensitive businesses. Regulators, investors, and fan groups now talk more about governance because of episodes such as his.

His era also forced teams and leagues to rethink financial rules. New owners learned to balance short-term deals with long-term stability. The business models of many clubs now include stronger oversight in finance and transparency clauses when outside investors are involved. The Liverpool sale remains a touchstone for those debates.

Industry Reaction and Notable Tributes

Tributes arrived quickly. Liverpool FC offered condolences. The NHL and former players noted his role in building the 1999 Stars team. Texas business leaders and sports figures, including Dallas Cowboys owner Jerry Jones, publicly mourned his passing. Family statements emphasized his role as a father and community leader. These messages mixed personal warmth with sober reflections on his controversial business record.

Conclusion: A Complicated Record

Tom Hicks combined ambition with aggressive finance. He won big moments. He also sparked bitter disputes. His life shows how modern sports sit at the crossroads of capital and culture. The December 6, 2025, death marks the end of a chapter that rewrote rules about who pays for success in big sports. Historians and sports economists will study his era for years to come.

Frequently Asked Questions (FAQs)

When did Tom Hicks die?

Tom Hicks died on December 6, 2025, in Dallas. He was 79 years old. His family shared the news, and many sports teams later posted public tributes online.

What teams did Tom Hicks own?

Tom Hicks owned the Dallas Stars, the Texas Rangers, and held a major stake in Liverpool FC. His ownership years were different for each team and brought mixed results.

Why was Tom Hicks’ time at Liverpool disputed?

His time at Liverpool was disputed because fans disliked rising debt and slow progress on the stadium plan. Tension grew until the club was sold in October 2010.

Disclaimer

The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.