Major League Baseball is up for another round of Collective Bargaining Agreement negotiations between the players’ union and ownership after the conclusion of the 2026 season.

As with the last CBA negotiations in the 2021-22 off-season, many anticipate a lockout will ensue for most of the off-season. Some league officials have even told members of their MLB Fan Council that they expect the lockout to cut into a significant portion of the 2027 season.

We still don’t know how many games will be lost to labor negotiations. There will be several issues at the forefront of the negotiations that the players’ union and owners are widely apart on, including a salary floor/cap, revenue sharing, and television rights.

The labor negotiations will overshadow much of the 2026 season as the date draws closer for owners and the MLBPA, and it’ll be an intriguing time for those new to the MLB ownership circle. The newest members include Tom Pohlad and the Minnesota Twins’ minority ownership group.

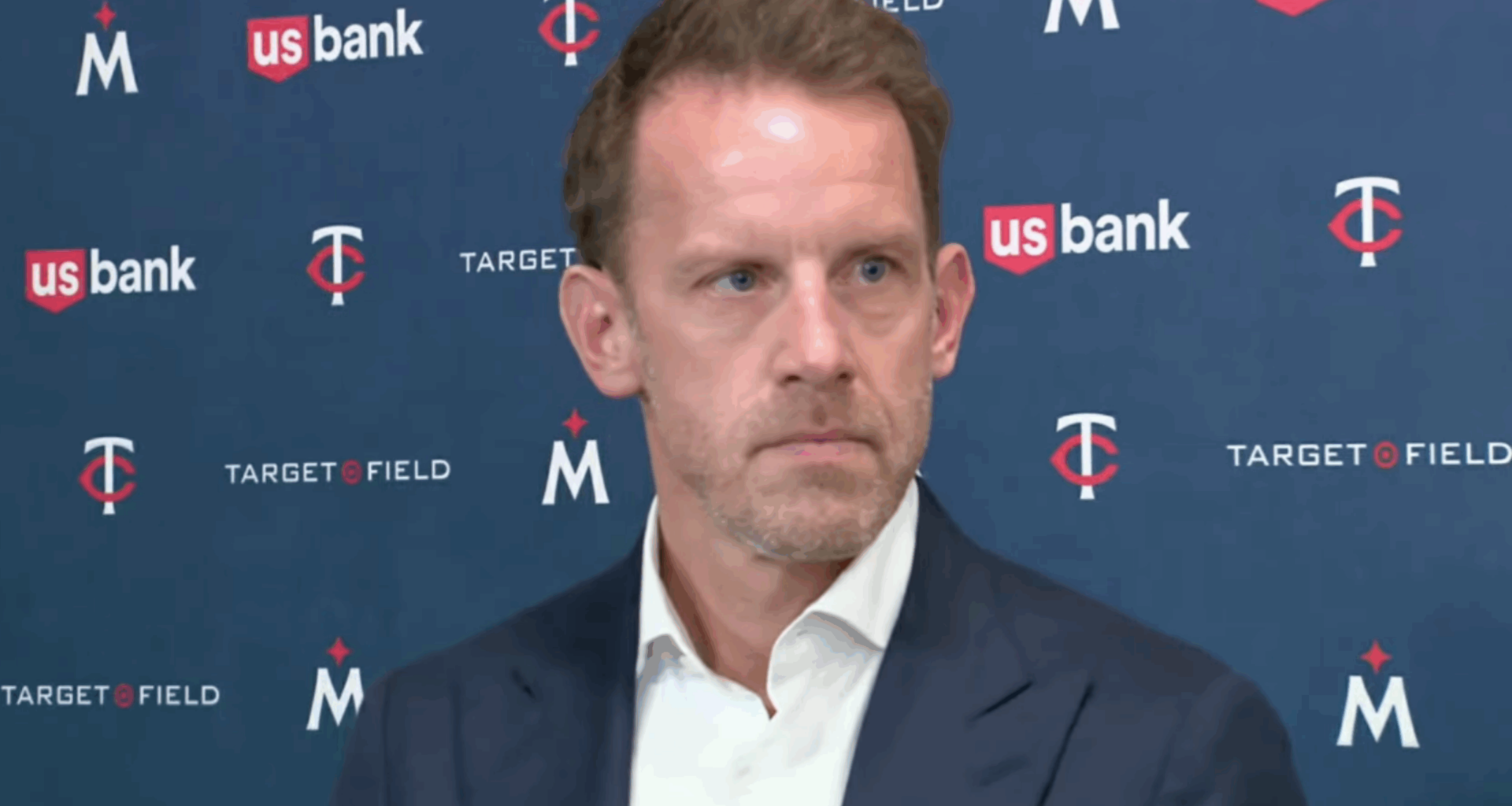

Pohlad will be the only one of this group involved in the labor negotiations on the ownership side. During his introductory press conference on Dec. 17, he was asked whether the current MLB business model helps small-market teams like the Twins and whether the upcoming CBA negotiations will include any improvements for them.

“I think it’s pretty well documented that small, middle-market teams in the sport of baseball face different challenges than that of those in the NBA, NFL, or NHL,” Pohlad said. “And so I’ve got to believe that when the CBA comes up that there will be an opportunity for everybody involved to figure out what’s in the best interests of the sport as it relates to the fans, the players, and the organizations. As far as that, I certainly don’t want to get ahead of myself, and I certainly don’t want to get ahead of the league.”

Major League Baseball is the only one of the big four leagues in North America that does not have a salary cap. Some believe it will help smaller-market teams like the Twins sign big-name free agents more easily, while others argue that the salary floor would be more beneficial by forcing smaller-market teams to spend more on payroll.

The argument for a salary floor makes more sense in Minnesota’s case. Their team payroll has diminished from $165 million in 2023 to just above $100 million as the new year approaches.

Many superstars in baseball are against the salary cap, as two-time MVP Bryce Harper was vocal about in 2025. The owners are also unlikely to budge on the salary floor because many teams in the bottom third of spending are trying to keep payroll down to increase their share of the revenue. That’s why these upcoming labor negotiations are likely to be the longest since the 1994-95 players’ strike.

The salary cap/floor argument will be at the forefront of these negotiations. Still, another important part to follow will be the future TV and broadcasting model for the league and teams. The Twins will remain under the same production and distribution umbrella as Major League Baseball, with more subscription options for Twins fans in 2026.

But the overall landscape for MLB teams’ regional sports network (RSN) models is still trending downward, just as it did when Diamond Sports owned half of MLB teams’ RSN rights. Nine teams are still under Bally’s successor company, Main Street Sports Group (FanDuel Sports Network), for their RSN distribution, and the Twins are one of six teams under MLB’s RSN umbrella.

The major market teams in New York, Los Angeles, and Chicago are still generating significant revenue from their own RSN models and deals. Therefore, they don’t have the issues the Twins, Cleveland Guardians, and San Diego Padres have faced. These issues haven’t completely gone away. Main Street Sports Group is looking to sell its majority stake to a group based outside of the U.S.

Fortunately for the Twins, they will not be impacted by the outcome of Main Street Sports Group’s sale, as the Timberwolves and Wild will be in the market. However, if a third company is set to own the RSN rights for teams for the third year in a row, that will put many teams in RSN free agency right as the CBA negotiations get underway next year.

There are many unknowns about the future of MLB’s economy under the upcoming CBA. The negotiations will undoubtedly delay the season longer than it was in 2022. However, as for what things could look like after the salary cap/floor, RSN, and revenue sharing, Pohlad feels assured the economics of the game will look much healthier than they appear now.

“I think the investors’ interest in the Twins is threefold,” Pohlad said. “First and foremost, yes, they are hopeful that there’s the reform that you just mentioned, but two. They believe there is an opportunity to improve the Minnesota Twins’ business.

“There are revenue opportunities to grow here, and they come from reengaging our fans and winning more baseball games. Three, I think as we develop relationships as we did through this process, they were really comfortable, convinced, and ultimately, confident that we were the right people to continue to lead this organization.”