Northpointe Bancshares (NPB) has rounded out FY 2025 with fourth quarter revenue of US$67.8 million and basic EPS of US$0.53, while trailing 12 month revenue reached US$239.6 million and EPS came in at US$2.14 on net income of US$71.6 million. The company has seen revenue move from US$42.4 million and EPS of US$0.34 in the fourth quarter of 2024 to US$67.8 million and EPS of US$0.53 in the fourth quarter of 2025, setting the scene for a discussion that centers on how its expanding net profit margin and earnings profile shape the current results.

See our full analysis for Northpointe Bancshares.

With the latest figures on the table, the next step is to see how these margins and earnings trends line up with the widely held narratives around Northpointe Bancshares and where that story might need updating.

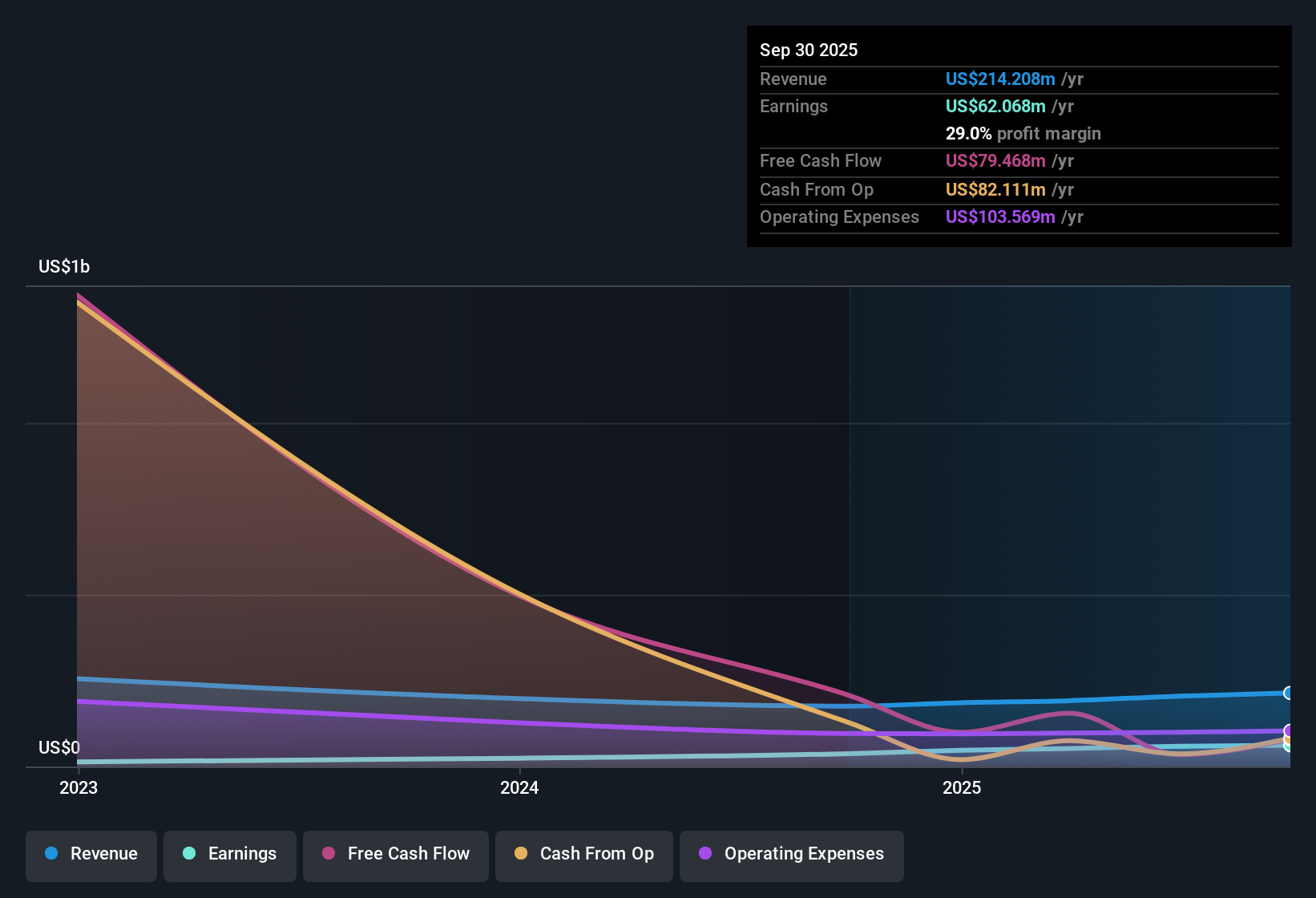

NYSE:NPB Earnings & Revenue History as at Jan 2026

51.9% earnings growth backs stronger margin story

Over the last 12 months, net income was US$71.6 million on revenue of US$239.6 million, which lines up with a net profit margin of 29.9% compared with 25.4% a year earlier and TTM EPS of US$2.14.

What stands out for the bullish view is that reported earnings grew 51.9% year over year while the margin moved to 29.9%. Supporters may see this as consistent with a model focused on mortgage and retail banking. However, revenue is forecast to rise 8.7% per year, below the 10.5% forecast for the broader US market, so the mix of higher profitability and slower expected top line is something bulls need to weigh carefully.

Supporters can point to the 51.9% earnings growth and EPS moving to US$2.14 over the last 12 months as evidence that the current banking mix is producing stronger profit per dollar of revenue.

At the same time, the 8.7% revenue growth forecast versus the 10.5% US market forecast shows that even a more profitable bank might not match the broader market on sales growth, which can matter if growth expectations tighten.

To see how this earnings jump fits into the longer term story and valuation work, you can read the full narrative that ties these numbers together.

📊 Read the full Northpointe Bancshares Consensus Narrative.

Loan book and credit reserves sit against low 15% allowance

Total loans reached US$5,967.2 million by Q3 2025 with non performing loans at US$83.9 million, while the allowance for bad loans is described as low at 15% in the risk data.

Bears focus on this relatively low 15% allowance for bad loans and argue that a mortgage heavy and retail banking model could feel more pressure if asset quality weakens. The loan figures give them concrete numbers to point to.

Critics highlight that non performing loans were US$83.9 million at Q3 2025 and over US$78 million in prior periods, so provisioning levels matter a lot if conditions change.

On the other hand, reported net income of US$71.6 million over the last 12 months shows that profitability currently covers those problem loan balances, which may challenge the idea that credit issues are already eating into results.

P/E of 8.7x and US$18.22 price sit below DCF fair value

The shares trade at US$18.22 with a P/E of 8.7x compared with a peer average of 12.5x and industry level of 11.8x, and the supplied DCF fair value of US$21.26 suggests the price is about 14.3% below that estimate.

Supporters of a bullish stance often argue that stronger profit margins and the 51.9% earnings growth paired with an 8.7x P/E and a discount to the US$21.26 DCF fair value look like a value setup. Those same figures also set a clear reference point if sentiment shifts and the market decides to pay closer to peer or industry multiples.

The gap between the 8.7x P/E and the 12.5x peer average is one way bulls frame the stock as priced below a group of comparable banks despite the higher 29.9% net margin.

At the same time, the US$18.22 share price versus the US$21.26 DCF fair value estimate offers a numerical anchor for investors who want a specific reference point rather than just a relative multiple argument.

Next Steps

Don’t just look at this quarter; the real story is in the long-term trend. We’ve done an in-depth analysis on Northpointe Bancshares’s growth and its valuation to see if today’s price is a bargain. Add the company to your watchlist or portfolio now so you don’t miss the next big move.

See What Else Is Out There

Northpointe Bancshares combines a 29.9% net margin and 51.9% earnings growth with a relatively low 15% allowance for bad loans against US$83.9 million in non performing balances.

If that credit reserve profile makes you uneasy, use our solid balance sheet and fundamentals stocks screener (391 results) today to zero in on companies with sturdier cushions and balance sheets built to handle stress.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.