The 2022-26 MLB Collective Bargaining Agreement (CBA) expires on December 1, 2026, at 11:59 p.m. ET. For anyone unfamiliar with the sprawling 442-page contract, the CBA outlines how Major League Baseball operates. It addresses spring training allowances, revenue-sharing guidelines, minimum salaries, deferred contracts, and more. Tony Clark, the Executive Director of the Major League Baseball Players Association (MLBPA), and MLB commissioner Robert Manfred have both indicated that they anticipate a lockout after the current CBA expires. Manfred even went as far as to state:

Quote

“In a bizarre way, it’s actually a positive. There is leverage associated with an offseason lockout and the process of collective bargaining under the NLRA works based on leverage. The great thing about offseason lockouts is the leverage that exists gets applied between the bargaining parties.”

Competitive parity in MLB and the potential implementation of a salary cap, which the MLBPA vehemently opposes, are already being discussed. Other major topics include the international draft, integrity protections with the rise of gambling, and combating service time manipulation.

Manfred has been gearing up for a potential lockout. In 2023, he launched the Commissioner’s Ambassador Program (CAP) to “represent the game at MLB events and support the league’s international growth, among other responsibilities”. This past season, Manfred toured MLB clubhouses, sometimes bringing CAP members. Historically, the MLBPA has been the bridge between players and the commissioner’s office. CAP however, is leapfrogging union reps and player agents to directly advise players under the guidance of the commissioner’s office, fueling further tension.

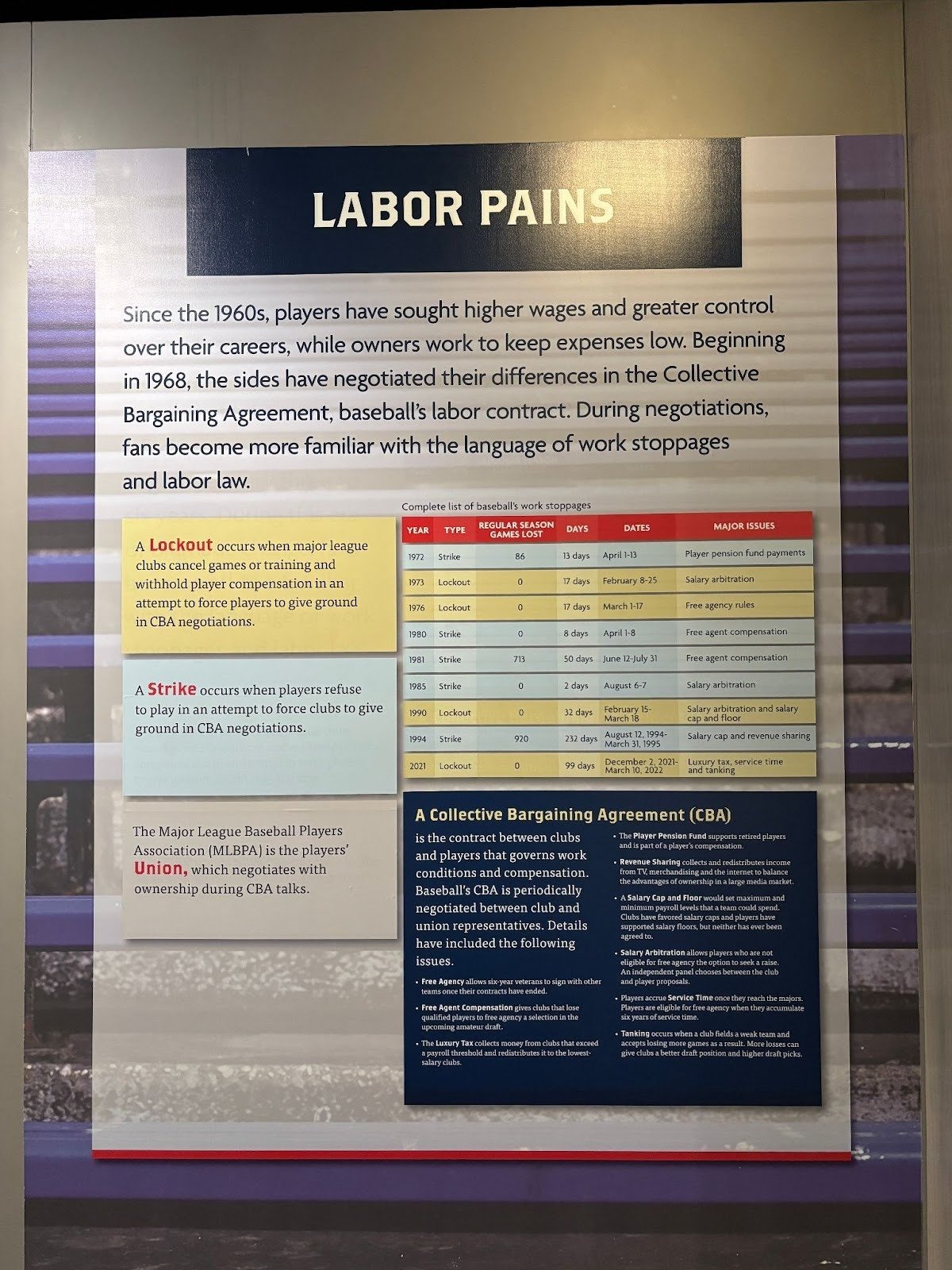

*Picture of the chart taken during a recent visit to the Baseball Hall of Fame

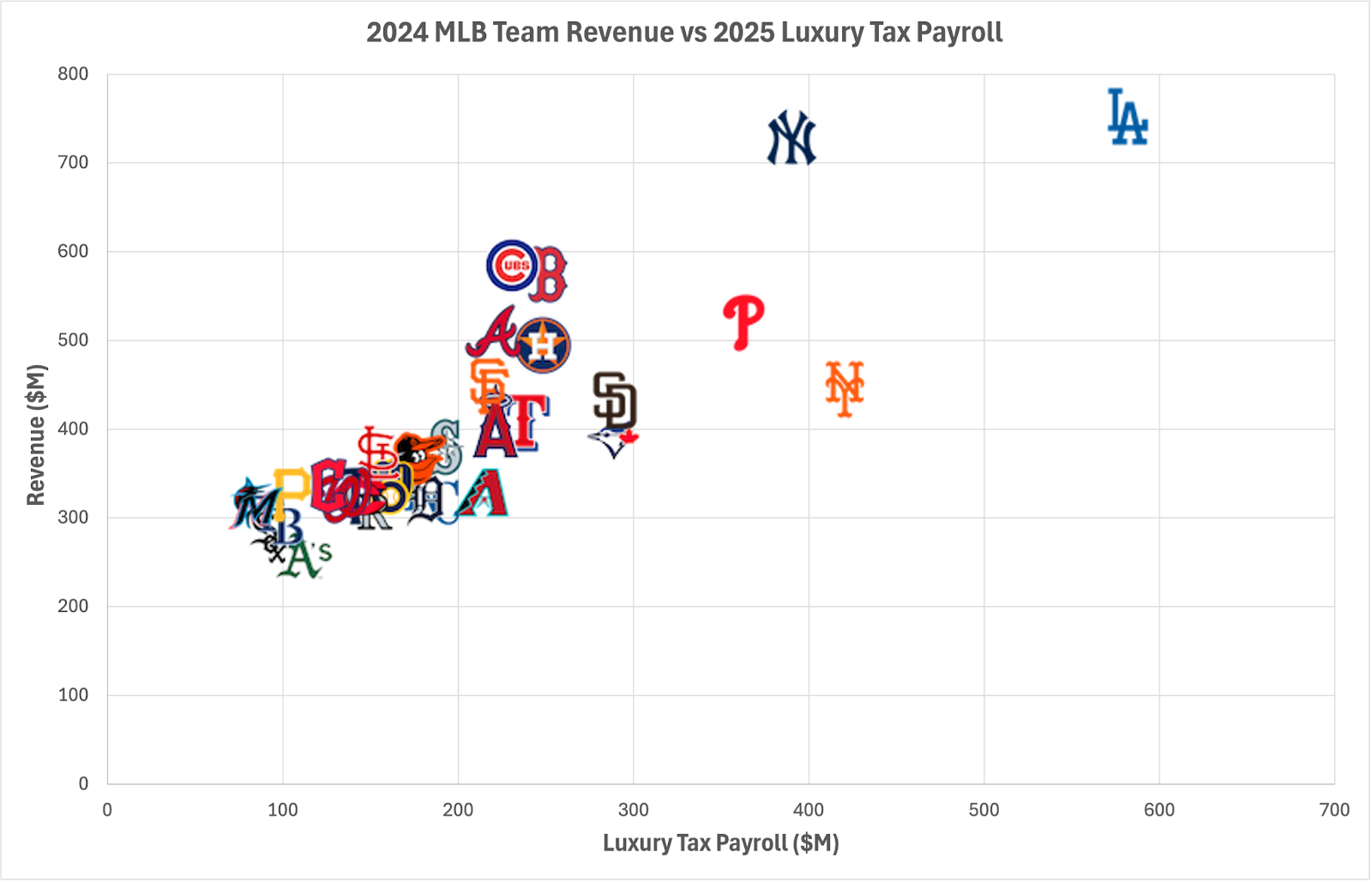

The Los Angeles Dodgers’ back-to-back World Series titles, achieved with top-three payrolls in both seasons, have intensified discussions about a salary cap. Their spending frenzy last offseason led to a record-breaking $582.25 million luxury tax payroll in 2025. While World Series runner-ups are often afterthoughts in the history books, the Dodgers’ victories came against other high-payroll teams, the New York Yankees in 2024 ($389.17 million) and the Toronto Blue Jays in 2025 ($288.60 million).

For once, I agree with Bryce Harper. Whining about the Dodgers’ spending is not worth the attention. The Dodgers are a well-oiled machine. Besides consistently signing quality free agents, they have one of, if not the largest, analytics departments across all professional sports. The other 29 teams in the league could beef up their analytics staff and allocate more revenue towards their payroll, but they choose not to. Why should the Dodgers be held liable for the Pirates allocating only 32.4% ($105.67 million) of their revenue towards their payroll in 2025? It’s absolutely asinine for the rest of the league to bemoan the willingness of the Dodgers’ ownership to invest in the team and not match their moves. Every team had the financial resources to offer Shohei Ohtani a 10-year $700 million contract with its mind-boggling deferrals. Any organization could have signed Blake Snell, a two-time Cy Young Award winner, to a long-term deal, despite concerns about his injury history. These moves, and many more, have consistently worked in the Dodgers’ favor. Luck certainly plays a role in the Dodgers’ player acquisitions, but the decisive factor in their success is their willingness to act when other teams won’t.

Sources: Forbes, Cots Contracts

In an attempt to mitigate disparity, the CBA penalizes excessive spenders with the Competitive Balance Tax (CBT). If a team’s 40-man roster payroll exceeds the set yearly CBT threshold, it is taxed on the overages, with rates increasing for consecutive seasons of overspending. This past year, the CBT threshold was $241 million, and in 2026, it increases to $244 million.

The CBA lays out MLB’s revenue-sharing model. Teams contribute to a shared pool, determined by a fixed percentage of net local revenue (the club’s local revenue minus actual stadium expenses), which is then distributed evenly to all 30 clubs. The exact percentage has fluctuated over the years, and it’s currently set at 48%. Jake McKibbin from Talk Sox’s sister site, Brewer Fanatic, notes MLB’s current model has two glaring loopholes:

Some teams have managed to avoid paying what they should owe; and

The revenues shared are then distributed equally, rather than on a meritocratic basis. That disincentivizes some teams from trying to win and improve the on-field product.

Many teams have partial ownership of local/regional sports networks. As long as its accounting adheres to the generally accepted accounting principles, it has flexibility in how profits are allocated. McKibbin further outlines the loophole, stating: “While revenue from local TV rights is subject to sharing across the league, profits generated through ownership stakes in the broadcasting networks are not. Instead, they are treated as a subsidiary/investment earning.”

The current landscape of the free-agent market highlights how teams are preparing for the lockout. The Angels signed former player Kurt Suzuki as a manager to an unusual one-year deal. Shifting from previous years, four players accepted qualifying offers. Shane Bieber and Jack Flaherty surprisingly opted in with their respective teams instead of hitting free agency.

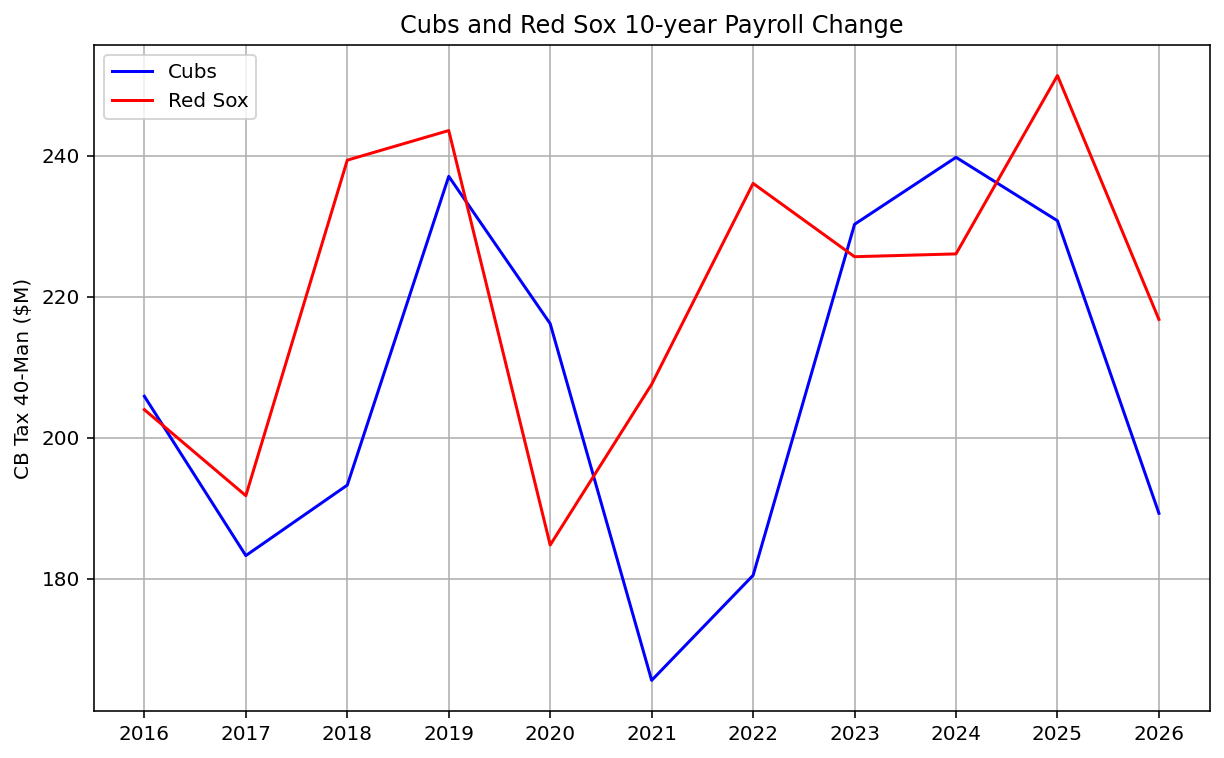

While teams like the Dodgers, Phillies, and Blue Jays continue to spend aggressively to contend, the Cubs and Red Sox have each adopted different approaches to roster construction amid the uncertainty of a potential lockout. Both organizations reflect the character of their cities and the legacy of their longstanding franchises. Theo Epstein shepherded the Red Sox out of their 86-year championship drought and the Cubs out of their 108-year championship drought. Their respective owners, the Ricketts Family and Fenway Sports Group, rejected proposals to relocate each team from the two oldest ballparks in baseball. The Cubs invested nearly $1 billion to revamp the neighborhood surrounding Wrigley Field, while the $1.6 billion Fenway Corners development project is underway for the Red Sox. Craig Counsell (five-year, $40 million contract signed in November 2023) and Alex Cora (three-year, $21.75 million contract covering 2025-27) are two of the sport’s most respected and highest-paid managers. In recent years, they have struggled to advance to the postseason and make a deep playoff run. There’s also a history of personnel flow between the organizations’ front offices. Red Sox Chief Baseball Officer Craig Breslow is a disciple of the Cubs President of Baseball Operations, Jed Hoyer, who, in turn, was mentored by Theo Epstein. Hoyer (who could pass as Anderson Cooper’s brother) held the following roles with the Red Sox: Assistant to the General Manager (2002), Assistant General Manager (2005-09), Co-General Manager (2005-06). Ryan Otero, the Cubs’ Director of Pitching, was recently hired as a special assistant to Breslow.

Despite netting $584 million in revenue, the third-highest in baseball, the Cubs’ 39.5% payroll-to-revenue ratio ranked 25th. The Cubs have mostly steered clear of long-term deals for frontline talent in recent years. Ten years ago, Hoyer, then general manager under Theo Epstein, oversaw the Cubs’ largest contract ever: Jayson Heyward’s eight-year, $184-million deal. Excluding Dansby Swanson’s seven-year, $177 million deal, most of the Cubs’ acquisitions since have been geared towards short-term deals; think Shota Imanaga’s original four-year, $53 million deal, signed in 2024, and Seiya Suzuki’s five-year, $85 million deal, signed in 2022. Homegrown players Nico Hoerner and Ian Happ were signed to three-year extensions in 2024. This past offseason, the Cubs offered Alex Bregman a four-year, $115 million contract that looked paltry in comparison to Detroit’s six-year, $171.5 million offer and the Astros’ six-year, $156 million offer. Bregman ultimately landed with the Red Sox on a three-year, $120 million contract. In Hoyer’s defense, he does his best with a limited budget imposed by ownership. He’s not afraid to jump the gun and make seismic deals, as evidenced by the Cubs’ blockbuster trade for Kyle Tucker.

Most alarming is that numerous key Cubs players enter free agency after the 2027 season, including left fielder Ian Happ, designated hitter/outfielder Seiya Suzuki, starter Jameson Taillon, second baseman Nico Hoerner, and catcher Carson Kelly. Looking beyond 2027, the Cubs’ list of free agents snowballs with each passing year. Entering the 2027 season, shortstop Dansby Swanson and reliever Phil Maton are currently the only two Cubs players with guaranteed salaries. With the Cubs set to lose a large portion of their roster after next year and the limited spending, fans have suggested the team is “clean books” strategy to prepare for the impending lockout.

The Cubs have developed a solid core of position players without spending heavily on free-agent talent. Cot’s Contracts projects that they can spend $46.12 million before hitting the first CB threshold. Their rotation needs an upgrade, and starters Framber Valdez, Ranger Suarez, and Michael King are potential targets. Extensions for homegrown talent, e.g. Pete Crow-Armstrong, are another avenue to build long-term roster stability. Moreover, the organization has been successful at recruiting Japanese talent to the team. Signing flamethrower Tatsuya Imai to a contract would assuage the “clean books” talks.

The Red Sox allocated 43.8% ($251.47 million) of their previous year’s revenue ($574 million, the fourth-highest total in the league) towards their 2025 payroll. Red Sox Chief Baseball Officer Craig Breslow is a former protege of Hoyer. Like the Cubs, the Red Sox tend to avoid long-term free-agent contracts. They’re one of the four remaining teams that haven’t signed a free agent to a major-league contract this offseason.

The difference between the Cubs and the Red Sox’s roster construction is that the Red Sox have extended their homegrown players beyond 2027:

Bryan Bello: 6 years, $55 million (2024-29), 2030 club option

Kristian Campbell: 8 years, $60 million (2025-32), 2033-34 club options

Ceddanne Rafaela: 8 years, $50 million (2024-31), 2032 club option

Garrett Crochet: 6 years, $170 million (2026-31)

Roman Anthony: 8 years, $130 million (2026-33), 2034 club option

Teams do their best to accurately value the risk of free-agent contracts. Execution is equally as important as evaluation, and Breslow’s primary area of weakness has been acquiring free agents to supplement the roster. Looking at FanGraphs’ “We Tried Tracker” from last year, the Red Sox whiffed on almost all of their free-agent targets. Who was the most “notable” free agent that they acquired during the 2024-25 offseason, besides Bregman? Walker Buehler?

Andrew Friedman, the Dodgers’ President of Baseball Operations, warned, “If you’re always rational about every free agent, you will finish third on every free agent”. Post-Winter Meetings, Kyle Schwarber and Pete Alonso, two of the available biggest bats, are off the table. While Schwarber always seemed primed to return to the Phillies, the Cubs and Red Sox reportedly met with Alonso. The latter had concerns with Alonso’s age (he just turned 31), defense, and baserunning.

Sometimes, you have to bite the bullet and take on the risk of a free agent contract, future projections be damned. Before the 2018 season, the Red Sox signed the 30-year-old J.D. Martinez to a five-year, $110 million deal. He generated 13.3 total fWAR through his tenure with the Red Sox. Roughly three-quarters of his WAR output came in 2018 (5.9) and 2019 (4.0). Towards the end of his contract, his performance declined, but it wasn’t a complete wash. With that being said, Martinez was, arguably, the linchpin of the 2018 team’s World Series run. The Red Sox’s homegrown core of Mookie Betts, Xander Bogaerts, Rafael Devers, Jackie Bradley Jr., and Andrew Benintendi desperately needed a power bat to supplement the lineup. Martinez was that solution. Other teams weren’t willing to bite, and the Red Sox took the risk of signing him. Would the current Red Sox front office sign Martinez? I think not.

A club with a substantial record of failed free-agent signings gains nothing by creating excuses about feigned concerns with a player’s profile or adding an extra year for a marginal sum when it sits at the top of the league in revenue. I’m not saying the Red Sox should necessarily overpay for free-agent contracts that don’t align with their current needs (take the Padres hoarding infielders on long-term contracts). Likewise, signing Kyle Tucker would just exacerbate the team’s outfield logjam. Still, adherence to strict rationalism won’t bolster their roster and doesn’t match the realities of the free-agent market.

As the offseason progresses, MLB organizations will continue to navigate the implications of the new collective bargaining agreement. The Red Sox have committed to a young core; whether they choose to supplement the roster further is up for question. The Cubs seemingly have built their roster around the lockout, with significant money coming off the books after the 2026 season. At the end of the day, the uncertainty surrounding the future payroll should not dictate roster-building decision-making. MLB free agency remains a free market, and teams must stay committed to putting the best possible roster on the field. Both the Cubs and Red Sox’s futures are bright, but failing to make significant upgrades through free agency will make it more challenging for each team to compete if or when they reach the playoffs.