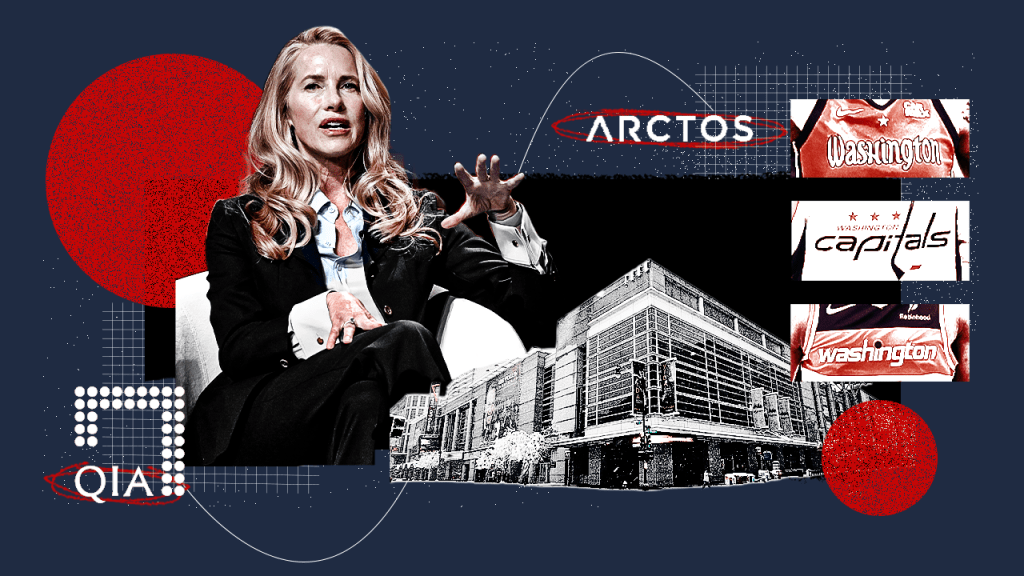

Qatari sovereign wealth fund QIA is increasing its investment in the parent company of the Washington Wizards and Washington Capitals, according to multiple people familiar with the plan.

QIA and Arctos Partners both have deals in place to buy passive minority shares in Monumental Sports & Entertainment from Laurene Powell Jobs at an enterprise value of $7.2 billion, said the people, who were granted anonymity because the details are private. The founder of Emerson Collective, Powell Jobs bought roughly 20% of Monumental in 2017 and was once the group’s largest shareholder outside of Ted Leonsis.

It’s unclear exactly how much equity each group is taking in the deal, or how their payments will be distributed. The two groups are not acquiring any board seats or other governance rights, the people said. Powell Jobs previously sold some of her holdings to another Monumental limited partner.

The deal has already been presented to NHL and NBA owners, the people said. Reps for QIA and Emerson Collective did not immediately respond to requests for comment. Reps for Monumental and Arctos declined to comment.

QIA bought a 5% passive minority stake in Monumental in June 2023, the first (and still only) sovereign wealth fund to invest directly into a major U.S. sports team. That deal valued Monumental, which has helped pioneer the mold of a modern sports platform company—major teams, minor league teams, real estate, media network and other related business—at $4.05 billion. Other Monumental assets include the WNBA’s Washington Mystics, Capital One Arena and Monumental Sports Network.

Sportico’s valuations do not encompass all of Monumental, but they reflect the group’s three biggest assets. The Wizards and Mystics are worth a combined $4.78 billion, according to Sportico’s calculations. The Capitals are worth $2.3 billion.

The NBA and NHL’s rules on institutional funds, both solidified a few years ago, restrict the amount of private capital that can be invested in any single team, and also how much a single fund can own. In both leagues, teams can sell a maximum of 30% to funds. Individual funds can only own up to 20% of a single franchise.

Founded in 2005, QIA is a separate entity from Qatar Sports Investments (QSI), which owns French soccer team Paris Saint-Germain (an Arctos portfolio company), though there is at least one shared board member. With $557 billion in assets, it is the ninth-largest sovereign fund in the world. Its other U.S. holdings include CityCenterDC, a mixed-use development just a few blocks from Capital One Arena.

Arctos has been by far the most prolific investor of the nascent U.S. sports private equity era. The group has done roughly two dozen franchise deals, and is the only firm so far to do so in all five major U.S. leagues. Arctos’ portfolio includes stakes in the Golden State Warriors, Liverpool, the Boston Red Sox, the San Francisco Giants, the Los Angeles Chargers, the Buffalo Bills, the Aston Martin F1 team and the Tampa Bay Lightning. According to the Financial Times, private equity giant KKR is in talks to acquire a “majority stake” in Arctos, which, given the concurrent timing, would be unlikely to impact the deal with Monumental.

Sportico was first to report that Powell Jobs was looking to sell some of her Monumental equity in January 2024.

She is worth about $14 billion, according to Forbes, a fortune that includes significant shares in Disney (NYSE: DIS) and Apple (Nasdaq: AAPL) from her late husband, Apple co-founder Steve Jobs, who died in 2011. Powell Jobs bought The Atlantic in 2017 and has invested in a number of other media companies, AI platforms and philanthropic efforts. She was part of a group that unsuccessfully bid on the Los Angeles Clippers a decade ago, and she participated in the WNBA’s 2022 capital raise.

In addition to Powell Jobs and QIA, Monumental’s minority investors include billionaire Jeffrey Skoll, BET co-founder Sheila Johnson and Washington Nationals owner Mark Lerner.