In a blockbuster trade, the NFL and ESPN formally announced their billion-dollar agreement that will see ESPN acquire NFL media assets — including NFL Network, linear distribution rights to RedZone and NFL Fantasy — in exchange for the NFL receiving a 10% ownership stake in ESPN.

The deal is really two agreements: In one agreement, ESPN will own and operate NFL Network, the RedZone Channel (as distributed by pay TV operators, like cable systems) and NFL Fantasy, which would merge with ESPN’s fantasy football product.

In a second agreement, the NFL will license to ESPN various assets that will help ESPN keep programming NFL Network, including three additional NFL games that will air on NFL Network, along with a shift of four other games to NFL Network, which will continue to air seven games each season.

Both agreements are pending approval, including from NFL ownership.

The deal was reported and confirmed by The Athletic’s Andrew Marchand last Friday.

The NFL Network, along with the NFL programming assets, will become a core part of ESPN’s upcoming direct-to-consumer service, named “ESPN” and launching formally in the next few weeks. ESPN’s DTC service will cost $29.99 per month.

Per the previous reporting from Marchand, the service will allow subscribers to bypass cable or satellite providers to watch all ESPN programming, including live games, through ESPN’s app. Viewers who already have access to ESPN’s networks through cable, satellite or bundled streaming TV services will also be able to watch ESPN through the new app.

The NFL held back several core media assets for itself, and the league will continue to own and operate NFL.com and all 32 team sites, NFL+, the NFL Podcast Network and the NFL “FAST” channel.

Notably, the NFL will continue to own, operate and produce RedZone and retains the rights to distribute RedZone digitally.

Per Marchand, ESPN and the NFL already have a strong relationship. The network is the home of “Monday Night Football” and airs a total of 25 NFL games per year. ESPN pays the NFL around $2.7 billion per year and has the rights to two Super Bowls in 2027 and 2031.

“NFL Network was started in 2003 and was looked upon as a potential competitor to ESPN,” Marchand wrote Friday. “While it gained traction and distribution, it never became a full-blown alternative to ESPN, whose studio shows focus more attention on the NFL than any other sport.

“NFL Network was plagued by cutbacks for years, even though the league is a multibillion-dollar juggernaut. ESPN is expected to invest in improving NFL Network programming, according to sources briefed on its plans.

“In the ESPN family of networks, NFL Network could be looked upon similarly to the SEC Network. The SEC offers programming 24/7 about the league, while ESPN, the main channel, dedicates significant airtime to it as well. The same sort of setup, with on-air personalities being used across brands, is very possible.”

ESPN’s existing equity split is 80% owned by a subsidiary of Disney (ABC, Inc.) and 20% owned by Hearst, an early investor in ESPN. The announcement did not disclose how the two current equity-holders would dilute themselves to account for the NFL’s 10% ownership stake.

Not mentioned in the announcement among the anticipated approvals: Any government regulatory approval.

Disney will hold its quarterly earnings call with analysts on Wednesday.

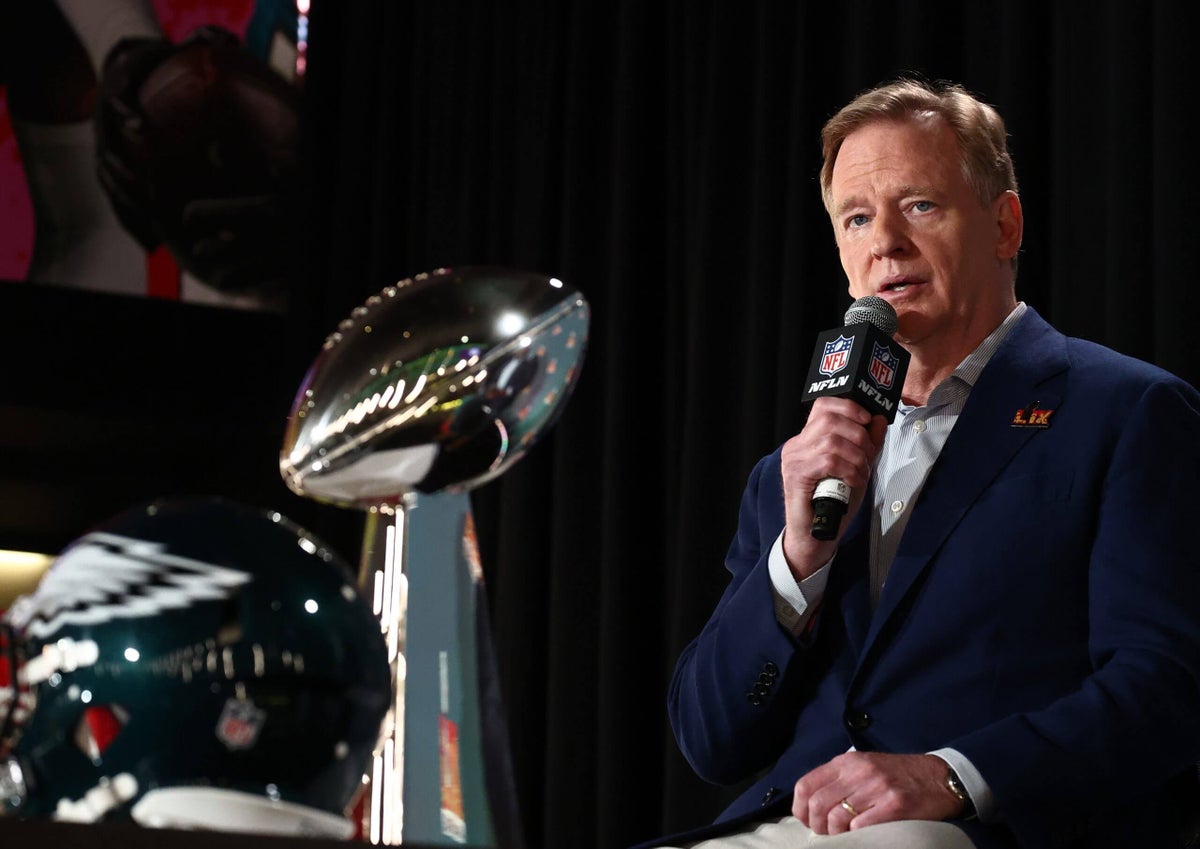

(Photo: Chris Graythen / Getty Images)