Shift4 Payments Inc. surges 5.6% as strategic partnerships and acquisitions fuel investor optimism.

Finance industry expert:

Analyst sentiment – positive

Shift4 Payments (FOUR) is currently displaying a mixed market position. On the surface, its profitability metrics, such as a gross margin of 32.6% and an EBIT margin of 10.5%, indicate strong operational efficiency. However, the financial health is worrisome, considering an extensive total debt-to-equity ratio of 2.87 and a high leverage ratio of 5.4, suggesting significant debt reliance. Revenue growth has been commendable, with a five-year increase of 38.61%, yet the pre-tax profit margin remains staggeringly low at 1.9%, pointing to potential inefficiencies in cost management. Evaluation of return metrics shows modest return on equity at 13.56% but highly concerning negative recent returns on capital, indicating operational challenges. Despite the high P/E ratio of 34.64, suggesting a confident market valuation, the need for stronger financial discipline is apparent.

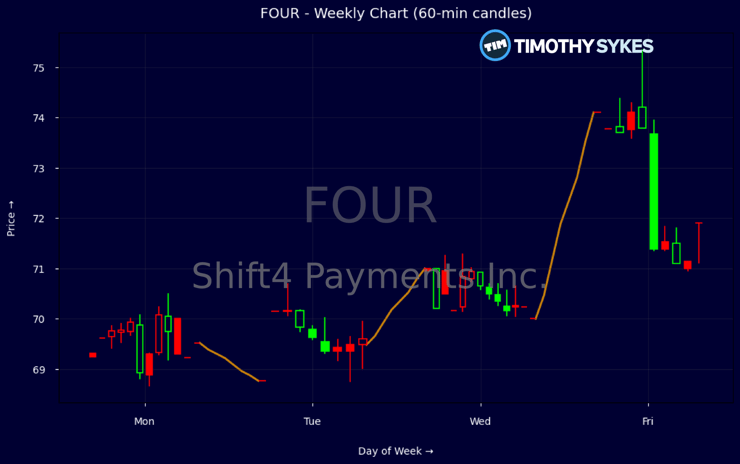

Technically, Shift4 Payments reveals a stabilization in its price movement based on the recent week’s data. The pattern illustrates a recovery attempt from an intra-week low of $68.7674 to an upward close at $74.1019. A notable price uptick occurred on November 26, marking $70.95, indicating a resistance level breakout potential that may propel further upward trends. Volume lacks concise data from this dataset, but the inflection around $70-$71.25 suggests strong accumulation zones. Based on these trends, a short to mid-term trading strategy involves capitalizing on continuation above the key $71.25 resistance level, targeting $75 as an extension of the bullish trajectory. Stop-losses should prudently be set below the $68.76 threshold to mitigate downside risk.

Catalysts transpiring around Shift4 enhance its narrative positively. Recent partnerships with major sports teams like the Cincinnati Bengals and Ottawa Senators to overhaul payment systems elevate its stature and visibility in the payment technology landscape. The company’s participation in the UBS Global Technology and AI conference may bolster investor sentiment and expand its institutional footprint. Analyst actions reflect a balance between price target reductions and maintaining positive ratings, propelled by strong organic growth forecasts and strategic share buybacks. Despite some near-term price target adjustments, investor consensus remains skewed towards optimism, backed by stable revenue growth and evolving sectoral synergy. Reflecting the above analysis, support around $69 is crucial, with resistance seen clearly at $74. Our outlook remains cautiously positive, transforming potential operational wrinkles into formidable growth opportunities in the evolving payment landscape.

Weekly Update Nov 24 – Nov 28, 2025: On Sunday, November 30, 2025 Shift4 Payments Inc. stock [NYSE: FOUR] is trending up by 5.6%! Discover the key drivers behind this movement as well as our expert analysis in the detailed breakdown below.

Quick Financial Overview

Shift4 Payments has displayed a notable financial performance recently, marked by solid Q3 outcomes that drove a positive response in the stock market. The company posted higher adjusted earnings and revenue, leading to a more than 7% surge in the stock. With revenue reaching approximately $3.33B, the firm’s key financial metrics underscore robust growth, yet highlight areas for improvement.

Key profitability ratios such as an EBIT margin of 10.5% and a gross margin of 32.6% suggest effective cost management and strong operational performance. However, a pretax profit margin of 1.9% calls attention to challenges in maximizing overall profitability. Meanwhile, Shift4’s price-to-earnings ratio of 34.64 indicates investor expectations of future profit potential, although it suggests the stock may be on the expensive side relative to its current earnings.

More Breaking News

The company’s balance sheet reflects a total asset value of nearly $9B, underpinned by a solid current ratio of 1.4, signifying decent short-term financial health. The leverage ratio stands at 5.4, indicating substantial debt, which may concern more conservative investors. In terms of income, the operating revenue totaled around $1.18B with a net income of $28.1M, solidifying its revenue-generating capabilities but with room to enhance net profitability.

Conclusion

In conclusion, Shift4 Payments is on a promising path marked by strategic partnerships and a reinforced market presence. Current financial indicators point towards steady growth potential, yet highlight the ongoing need to manage debt and optimize profitability. As millionaire penny stock trader and teacher Tim Sykes says, “Cut losses quickly, let profits ride, and don’t overtrade.” While the company’s recent moves with major sports franchises and strategic event participation signal a period of optimistic growth, close monitoring of financial metrics and execution of strategic initiatives will remain pivotal. Traders and stakeholders should watch how these developments unfold and impact the long-term value proposition of Shift4 Payments’ stock.

This is stock news, not investment advice. Timothy Sykes News delivers real-time stock market news focused on key catalysts driving short-term price movements. Our content is tailored for active traders and investors seeking to capitalize on rapid price fluctuations, particularly in volatile sectors like penny stocks. Readers come to us for detailed coverage on earnings reports, mergers, FDA approvals, new contracts, and unusual trading volumes that can trigger significant short-term price action. Some users utilize our news to explain sudden stock movements, while others rely on it for diligent research into potential investment opportunities.

Dive deeper into the world of trading with Timothy Sykes, renowned for his expertise in penny stocks. Explore his top picks and discover the strategies that have propelled him to success with these articles:

Once you’ve got some stocks on watch, elevate your trading game with StocksToTrade the ultimate platform for traders. With specialized tools for swing and day trading, StocksToTrade will guide you through the market’s twists and turns.

Dig into StocksToTrade’s watchlists here: